Precision Investments, Personalized Performance

Generating an extensive menu of investment solutions across global markets, asset classes, industries, themes, factors, benchmarks, ETFs, and securities to match any objective, strategy, and style…increasing the likelihood of successful investment outcomes

Why Choose Lumen R4A?

- Bespoke Portfolios: Tailored to fit your unique investment goals and risk preferences.

- Innovative Methodology: Beyond volatility, focusing on strategic, value-based meticulous asset selection.

- Dynamic Market Integration: Leveraging real-time opportunities and decades of investment experiences for optimal asset allocation.

Introducing R4A, Robo4Advisors

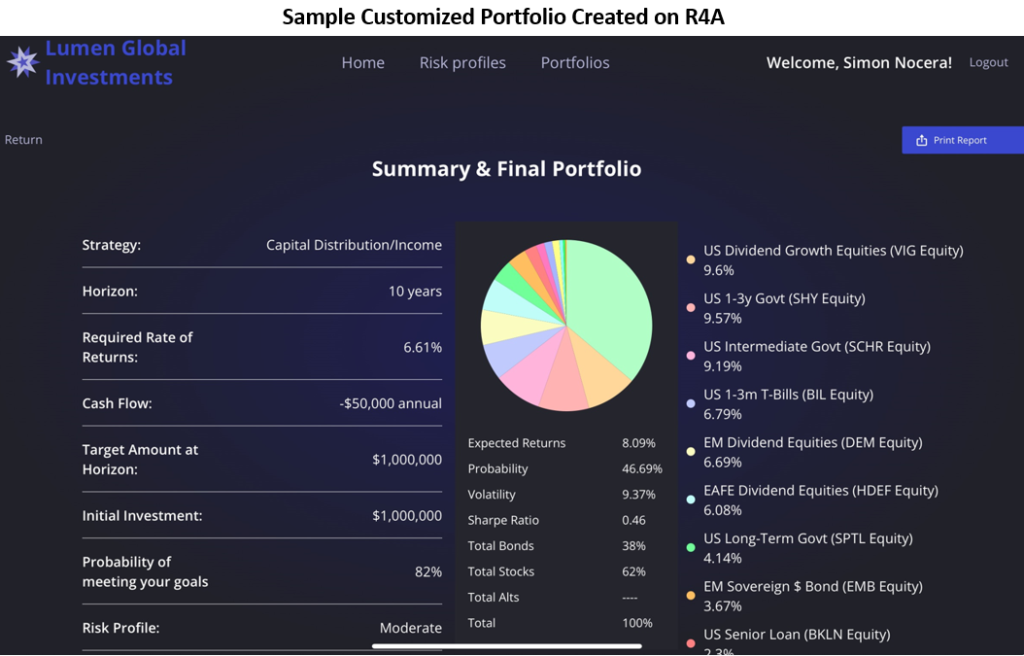

Our Edge – R4A is an innovative digital platform that turns real-time infinite global market investment opportunities into fully customized, highly diversified portfolios.

We maximize by construction your chances of success by combining precise and expert value-driven analysis with systematic portfolio construction, a quantum leap from the industry’s practice of cookie-cutter, one-size-fits-all models, blind preset 60/40 allocation.

R4A’s advantage rests on two foundational pillars. First, we begin the construction of every investment solution by defining your precise investment objective—whether that’s stable income, capital preservation, targeted growth, or trading — and then we design a strategy that maps directly to that goal. That one-to-one alignment, by construction, meaningfully elevates the likelihood of reaching your desired goal and successful outcome. This is a far cry from the industry practice to build portfolios based on risk buckets erroneously proxied by (past) volatility and applying one-size-fits-all predetermined arbitrary pseudo-optimization (the 60/40 bit) across a handful of major benchmarks.

Second, we sidestep the inherent biases, pitfalls, and costs of discretionary forecasts – an expensive exercise of overconfidence – by mining expected returns straight from market prices. In today’s world, where every piece of relevant information circulates globally in real time at zero cost and in the palm of one’s hand, prices instantly reflect that data—precisely the hallmark and definition of an efficient market. The proof, not surprisingly, 98% of active managers have been unable to outperform the market; they’re competing against the collective wisdom embedded in those prices … right 98% of the time!

To exploit and capture this market efficiency, we built the Lumen Global Value Compass, a proprietary algorithm that reverse engineers each asset’s implied expected return. Unlike other approaches, our proprietary Compass has three unique and crucial attributes for successful asset allocation. It delivers a single metric that is truly unbiased (no subjective calls), forward-looking (driven solely by today’s prices) and universal (apples-to-apples across stocks, bonds, commodities, factors, themes, ETFs and more).

Armed with those return estimates, our proprietary optimizer is capable of sculpting highly diversified, goal-aligned portfolios that not only practice the most effective risk management methodology, but at the same time exploit opportunities at the most granular level across the majority of the global capital markets—without ever having to forecast thousands of individual returns, an impossible and dangerous exercise. The outcome is a suite of solutions that are custom-built for your objectives, thus materially increasing the probability of successful investment outcome, and deliver superior performance. All in real-time and at digital speed within a user-friendly environment.

The What – A revolutionary approach to wealth management and portfolio construction matching investment objectives with the appropriate strategies

R4A (Robo for Advisors)’s distinctive and unique hallmark lies in its unparalleled ability to construct highly customized and meticulously diversified portfolios, driving, by construction, superior performance. We challenge the conventional practice of “model portfolios,” which inaccurately differentiate only by volatility, group investors into simplistic categories—such as conservative, moderate, or aggressive, apply an arbitrary asset allocation—the obsolete 60/40 – all leading in the end to a one-size-fits-all solution and disappointing results.

Instead, by precisely recognizing and aligning diverse objectives and risk preferences with diverse and specifically tailored investment strategies, R4A inherently enhances the probability of successful investment outcomes. Our motto, “One can’t manage what one can’t define…and tailor,” underscores the importance of customization in wealth management.

For example, if the investment objective is capital growth, the R4A Predefined Growth strategy will boast direct exposure to growth assets, such as growth ETF, rather than indiscriminately increasing exposure to generic stocks benchmarks—a practice that frequently increases risk with no benefits! R4A’s unique ability to tailor strategies extends to other investment objectives including income generation, capital preservation, long-term wealth accumulation, passive investment, aggressive growth, trading, etc., and everything in between!

The How – An extensive, open-source, unbiased, and forward-looking database of global opportunities and investment combinations

The core of R4A’s unique capability is an extensive proprietary database that meticulously covers and ranks by value and in detail the global capital market. This database enables us to generate unlimited investment combinations, strategies, and optimal portfolios matching the most specific investment objectives, from retail investors to the most demanding institutional mandates.

Powering this database is our equally unique proprietary methodology, the Lumen Global Value Compass. Leveraging AI and Big Data, this innovative tool provides a value-based, real-time, detailed ranking of the global capital market using a single value metric for an unbiased, apples-to-apples, and forward-looking comparison of countless investment opportunities and needs. The resulting expansive, open-source ranking encompasses every market (global, developed, emerging, frontier), asset class, sector, industry, and investment factor (e.g., growth, value, quality, etc.), and a vast array of ETFs, alternatives such as Real Estate and Private Equities, thematic areas such as ESG, cybersecurity, and renewable energy, and including every publicly-traded individual security.

This methodology and unique capability unlock an infinite pool of granular investment ideas and combinations, tailored into unique portfolios that meet the widest range of objectives, goals, and strategies, thus materially raising the probability of successful investment outcomes.

Using our database and proprietary optimizer R4A delivers an unbiased optimal asset selection and allocation, thus challenging the outdated and arbitrary 60/40 allocation between stocks and

bonds—a practice that has been shown increasingly costly in recent years. R4A’s asset allocation methodology is rooted instead in fundamental value expert research, utilizing real-time analysis for optimal asset allocation, a quantum leap from the inaccuracy of the old 60/40 and its variations based on volatility alone.

The Why – An infinite number of investment solutions satisfying the most diverse and unique goals, leading to improved investment outcomes and performance

The key advantage of R4A lies in its extensive, open-source, detailed ranking capability of global investment, which enables the production of unlimited investment strategies and tailored portfolios leading by construction to successful investment outcomes. Each portfolio is meticulously crafted to meet the most diverse objectives and strategies, from retail investors to the most demanding institutional mandates, making R4A a trailblazer in wealth and investment management.

This is next-generation asset allocation. We’ve moved beyond optimization as a theoretical exercise. Our platform uses real data, in real time, to build solutions that reflect both the investor’s objective and the current reality and granular opportunities of modern global capital markets.

~ Simon Nocera, Founder, CEO, and Managing Partner

What We Provide

A comprehensive toolkit for end-to-end portfolio creation, delivering everything needed to take the driver’s seat in investment journeys.

R4A provides the car, the GPS, and the fuel–you choose the destination!

Functions

- Comprehensive Global Database *

- Securities, ETFs, Benchmarks

- Global Markets, Asset Classes, Sectors, Industries, Themes, Factors

- Global Search Engine with 3 Ways *

- Discovery by Countries/Sectors

- Global Strategy

- Predefined Strategies Matching

Objectives

- 360 Degree Risk Profiling

- Psychometric Analysis for Risk

Tolerance - Risk Capacity

- Required Returns

- Psychometric Analysis for Risk

Tools

- Selection Tools *

- Rank Investments based on

Fundamentals - Aggregation Tool/Custom Indexing to create Customized Benchmarks

- Rank Investments based on

- Strategy Enhancement *

- Our Proprietary Version of the Black-Litterman Model that Includes Personal Views/Insights

- Portfolio Optimization by B&L**

- Building an Efficient Frontier for Best Balance of Risk and Return

- Risk Measurement

- VaR, CVAR, and Monte Carlo

Simulations to Measure- Downside risk, Stress Test,

Probability of Success

- Downside risk, Stress Test,

- VaR, CVAR, and Monte Carlo

Reports and Analytics

- Positions and Allocations

- Portfolio Attributes

- Risk Analytics

- Probability of Goal Reached

- Risk Profiling

*Available in the Enterprise version only

**Maximum 3 portfolio runs for Freemium users

Our Insights

Our Latest Research and Articles

06

Portfolio Construction

WHITEPAPER: Portfolio Construction and Global Asset Allocation: A Practitioner Solution to a Black-Litterman Flaw

Noteworthy Articles

- NEW! The Evolution of Active Management: From Stock Picking to Active Asset Allocation

- NEW! Missing the Forest (Sovereign Debts) For the Tree (Trump’s Policies) – Lumen R4A Long-Term Capital Market Assumptions

- NEW! What Drives American Exceptional Stock Performances in the Past 5 Years?

- R4A Definition of Predefined Investment Strategies

- Risk Profiling – A Comprehensive Framework

- The New New Alpha

- Lumen “Model Universes”: How Strategies Align with Investment Goals (view interactive map)

- What’s Next in Factor-Based Investing – Lumen Methodology

- Are Actively-Managed Mutual Funds Doomed?

- Wealth Management – Innovation and Game-Changing Trends for the Modern Investors

- The Mighty Dollar

Ready to start building your customized portfolio?

Transform your investment strategy today with Lumen R4A—where your goals meet our innovation

R4A—Built by Lumen Global Investments